Content

It represents temporary credit or debit transactions/entries made to an account for which the complete posting to update the balance will be done as part of EOD (end-of-day) batch processing. Many POS systems allow for a charge to be classified and processed as a force pay debit if the amount of the charge fits a certain criteria, or if the system loses connectivity to the network. A payment is forced through a POS using a previous authorization code, which is a series of digits, rather than authorizing a transaction through the issuer.

Accounting is the process of recording, summarizing, and reporting financial transactions to oversight agencies, regulators, and the IRS. The Bangko Sentral ng Pilipinas has directed BPI to provide a timeline and updates on the issue, particularly on the reversal of its erroneous transactions. “Given the high volume of inquiries on our online banking channels, you may experience intermittent access to our web and mobile app platforms,” BPI said. Explore how the signNow eSignature platform helps businesses succeed. Hear from real users and what they like most about electronic signing. After you debit memo save the executed doc to your device.

What is difference between debit note and invoice?

Therefore, each transaction on the bank statement should be double‐checked. If the bank incorrectly recorded a transaction, the bank must be contacted, and the bank balance must be adjusted on the bank reconciliation. If the company incorrectly recorded a transaction, the book balance must be adjusted on the bank reconciliation and a correcting entry must be journalized and posted to the general ledger. This error is a reconciling item because the company’s general ledger cash account is overstated by $63. A debit memo, also known as a debit memorandum, can be defined differently in different situations.

- Save time by creating templates in signNow and quickly customizing them.

- A cash memo is a document issued by a trader for the purpose of making a cash purchase.

- In the case of a credit settlement, a seller often issues a formal credit memo in response to the buyer’s debit memo to formally acknowledge the buyer’s request.

- Frequently, changes or modifications to earlier transactions are included in debit memos.

- The Vector Management Group’s bank statement on page 120 includes a $20 service charge for check printing and a $50 service charge for the rental of a safe‐deposit box.

These checks are called outstanding checks and cause the bank statement balance to overstate the company’s actual cash balance. Since outstanding checks have already been recorded in the company’s books as cash disbursements, they must be subtracted from the bank statement balance. Debit notes are issued by sellers, buyers and banks to inform the recipients that their accounts were debited in the senders’ accounting records.

Information About Credit Memo

Bpi what is force pay bpi debit memo issue in bpi without buying software. By issuing a force pay debit memo, the bank ensures that the cashed check is paid before any other item that comes in. Similar actions occur when you use the debit card at certain institutions that have priority processing, wire funds to another account or authorize an immediate electronic funds transfer. A debit memo on a company’s bank statement refers to a deduction by the bank from the company’s bank account. In other words, a bank debit memo reduces the bank account balance similar to a check drawn on the bank account.

Fraud committed through force pay debit transactions are a major concern for issuers and payment processors. Customers who seek to commit fraud may willingly incur force pay charges on their account and then dispute the charges for a full refund. Other attempts at fraud may include a customer offering an authorization code and requesting that a merchant force a payment knowing there are insufficient funds in the account. Debit transactions are not always posted based on their chronological date of occurrence.

Debit Memos in Incremental Billings

“Some ATM, CAM deposits, POS and e-commerce debit transactions from Dec 30 to 31, 2022 were posted twice. We are already working to reverse the duplicate transactions,” it said. SignNow is one of the leading eSignature solutions on the market. It’s always developing and improving its functionality to meet your most sophisticated requirements.

Debit memos are necessary for a transparent banking system and help you know what you are charged for. So, from now on, the next time a debit memo comes your way, you will find it familiar. It’s crucial to remember that the account is debited in the sender’s records, not the recipient’s when it comes to the entire phase debit memo. Debit memorandums are also used in double-entry accounting to indicate an adjustment that increases a customer’s amount due. To record the net amount of a successful debit and credit transaction, you can create a debit memo reversal.

Debit memos can arise as a result of bank service charges, bounced check fees, or charges for printing more checks. The memos are typically sent out to bank customers along with their monthly bank statements and the debit memorandum is noted by a negative sign next to the charge. A credit memorandum attached to the Vector Management Group’s bank statement describes the bank’s collection of a $1,500 note receivable along with $90 in interest. The bank deducted $25 for this service, so the automatic deposit was for $1,565.

Seller incrementally increases an amount on a previously issued invoice. Company A and Company B record the respective purchase and sale in their accounting books. Real-time Notification Get notified whenever estimates and invoices are opened or payouts proceeded.

What documentation issued by a bank increases a company’s checking account balance at the bank?…

A commercial seller, buyer, or financial institution may notify of a debit placed on a recipient’s account. They do this in the sender’s books by sending a debit note. Within a firm, a debit memo can be created to offset a credit balance that exists in a customer account. If a customer pays more than an invoiced amount, intentionally or not, the firm can choose to issue a debit memo to offset the credit to eliminate the positive balance. If the credit balance is considered material, the company would most likely issue a refund to the customer instead of creating a debit memo.

- Add late fees to a client’s account or customer site.

- To record the net amount of a successful debit and credit transaction, you can create a debit memo reversal.

- Find everything you need to know about electronic signatures.

- Although separate journal entries for each expense can be made, it is simpler to combine them, so bank fees expense is debited for $70 and cash is credited for $70.

- Because reconciling items that affect the book balance on a bank reconciliation have not been recorded in the company’s books, they must be journalized and posted to the general ledger accounts.

- Bank fees are one reason a bank may use a debit memo to decrease an account balance.

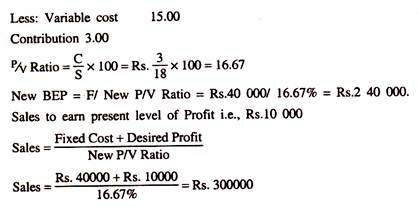

Debit memos and credit memos are closely related to each other. Although a debit note adds an extra payable amount to the original invoice. The credit memo cuts off the total amount of the original debit memo withdrawal invoice to a certain extent. One of the types of debit memos is the ones that are used in incremental billings. It is an incremental debit that should be included in the main invoice.

What is a debit memo?

Debit memos, also called debit notes, are corrections to invoices. If you accidentally submit an invoice that's too low, you can send a debit memo to correct it and increase the invoice after it's sent. The customer can then use the memo to adjust their books, as well.