On the same day, FASB issued yet another rule on how to account for securities when they were permanently impaired. The rule said that only the credit-loss portion of such impairments would affect a bank’s income and regulatory capital, with the rest (such as unrealized losses related to illiquidity) going into the special account for other comprehensive income. This IASB amendment had an immediate impact on the financial statements of European banks. In the third quarter of 2008, Deutsche Bank avoided more than €800 million in losses from write-downs in its bond and marketable loan portfolios by shifting assets to a more favorable category. Through the magic of relabeling, Deutsche Bank reported a third quarter profit of €93 million, instead of a loss of more than €700 million. More generally, European banks shifted half a trillion dollars from other categories to held to maturity—boosting their profits by an estimated $29 billion in total for 2008.

- Members are chosen by the trustees of the private Financial Accounting Foundation in a poorly understood process that is often influenced by the Securities and Exchange Commission.

- It is a particular problem when a business has older inventory or fixed assets whose current values may differ sharply from their recorded values.

- The bank would also publish a second EPS of 62 cents per share, with an explanation that this second EPS excluded those unrealized losses.

- Even if regulators were to further unlink bank capital calculations from financial results under fair value accounting, bankers would still be concerned about the volatility of quarterly earnings.

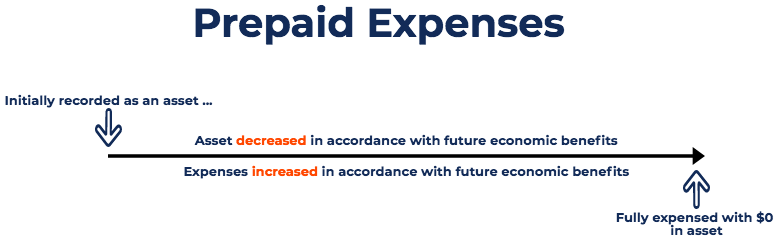

- This varies from the historically-used method of only recording assets and liabilities at the amounts at which they were originally acquired or incurred (which represents a more conservative viewpoint).

- A bank whose total net revenue—from fees and net interest income—was quite stable might see its overall earnings fluctuate significantly from quarter to quarter, thanks to changes in the current market values of its actively traded bonds and other assets.

Individuals and businesses may compare current market value, growth potential, and replacement cost to determine the fair value of an asset. Fair value calculations help investors make financial choices and fair value accounting practices determine the value of assets and liabilities based on current market value. Fair value is the highest price an asset would sell for in the free market based on its current market value. This means the buyer and seller are both knowledgeable, motivated to sell, and there is no pressure to sell (as in the event of a corporate liquidation).

Fair Value of Stock Index Futures

The fair value is determined in good faith by the fund’s board who are required to establish fair value methodologies and oversee pricing services. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information Current value accounting to millions of readers each year. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Specifically, as asset prices rose through 2008, the fair value gains on certain securitized assets held by financial institutions were recognized as net income, and thus sometimes used to calculate executive bonuses. And after asset prices began falling, many financial executives blamed fair value markdowns for accelerating the decline. The mark-to-market method of accounting records the current market price of an asset or a liability on financial statements. Also known as fair value accounting, it’s an approach that companies use to report their assets and liabilities at the estimated amount of money they would receive if they were to sell the assets or be alleviated of their liabilities in the market today.

How Is Fair Value Considered In the Accounting of Financial Assets?

When an investor buys a 50 call option, they are buying the right to purchase 100 shares of stock at $50 per share for a specific period. If the stock’s market price increases, the value of the option on the stock also increases. For nonexistent or illiquid markets, Level 3 inputs should only be used when Level 1 and 2 inputs are not available. This is generally reserved for assets that are not traded frequently and are the hardest to value, such as mortgage-related assets and complex derivatives.

If a company purchased a building several decades ago, then the contemporary market value of the building could be worth a lot more than the balance sheet indicates. As companies’ asset prices rose due to the boom in the housing market, the gains calculated were realized as net income. Suddenly, all of the appraisals of their worth were detrimentally off, and mark-to-market accounting was to blame. Fair value is also used in a consolidation when a subsidiary company’s financial statements are combined or consolidated with those of a parent company. The parent company buys an interest in a subsidiary, and the subsidiary’s assets and liabilities are presented at fair market value for each account.

Terms Similar to Current Value Accounting

The current value accounting method is used because it provides a more accurate picture of a company’s financial position. Those two retroactive rulings made it possible for large U.S. banks to significantly reduce the size of write-downs they took on assets in the first quarter of 2009. The rulings improved the short-term financial picture of these banks, although they also led bank executives to resist sales of toxic assets at what investors believed to be reasonable prices. When trading assets are classified as Level 3, because of illiquid markets or for other reasons, financial executives are allowed to value them by “marking to model” instead of marking to market.

What is the current value of an asset accounting?

The value of an asset is the most you would pay to own that asset. The value today is the discounted value of the sum of the dividend (or service flow) plus the future price of the asset.

When sharp, unpredictable volatility in prices occur, mark-to-market accounting proves to be inaccurate. In contrast, with historical cost accounting, the costs remain steady, which can prove to be a more accurate gauge of worth in the long run. For example, Company ABC bought multiple properties in New York 100 years ago for $50,000. If the company uses mark-to-market https://accounting-services.net/real-value-definition/ accounting principles, then the cost of the properties recorded on the balance sheet rises to $50 million to more accurately reflect their value in today’s market. Fair value accounting measures assets and liabilities at estimates of their current value whereas historical cost accounting measures the value of an asset based on the original cost of an asset.

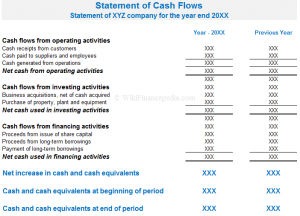

As a simple illustration, suppose a bank buys a bond for $1 million, and the bond’s market price declines to $900,000 at the end of the next quarter. Although the bank does not sell the bond, the left side of its balance sheet will show a $100,000 decrease in assets, and the right side will show a corresponding $100,000 decrease in equity (before any tax effects). This decrease will also flow through the bank’s income statement and be reported as a $100,000 pretax quarterly loss. Before we can begin to implement sensible reforms, though, we must first clear up some misperceptions about accounting methods.